Issue 8

Featured FlyPaper, For The Culture – Letter From The Editor 2016 Voters Guide! 9 Ways Obama Changed Life For Us…

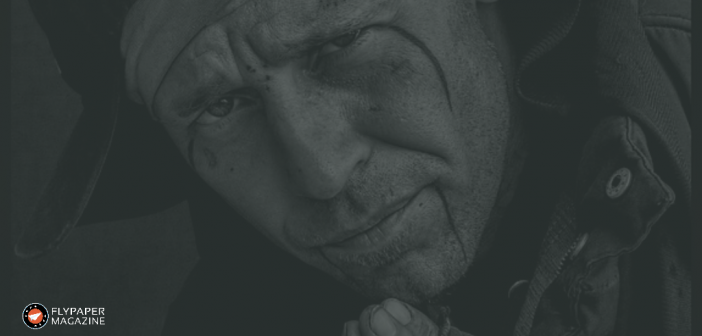

Collision Course – OG Vern Show Review – It Was Lit Fam.

Fresh off a series of recent performances throughout the Columbus rap circuit, OG Vern decided to present his skills in… https://fortune-tiger-1win.com/

Song: “F*ck Ya Whole Crew (Remix)” – Darrio Lamont feat. Nes Wordz, Trek Manifest, King Ezz, Sam Rothstein, C10, Blueprint, and Bo.

Darrio Lamont has been on a tear all 2016. After releasing A Trap Love Supreme in February he dropped a 90’s influenced album New…

Nancy Pelosi Didn’t Blow A 3-1 Lead

2016 seemed to be a year of the uprising of the unpredictable. In pop culture and social media would…

Nintendo Switch & PlayStation Vue: The Console War Expands

The console war is a topic that always reoccurs within the gaming community. Different companies that own gaming systems are…

The Self Made Fallacy | @adeshemsu

In reference to a person’s professional life, it is one of the biggest lies that a person can tell themselves.…

Why the #BlackLivesMatter Movement Matters | #FlyTake

“Freedom emerges from the very process of struggle,” proclaimed Ms. Davis, as I sat perched on my seat amongst an…

I Can’t Believe That The Popularity of Trump is a Good Thing, But Here We Are | OP-ED @Mr_CHarris23

Check your voter registration information here. (Editor’s Note: This Op-Ed was penned March 1, 2016) Hear Me Out 258 days…

Q&A with the Creative behind Black Card Revoked @keturahAriel | @brizy_duz_it

Whether it’s creating new pieces of art or selling out of her “Black Card Revoked” card game, Keturah Ariel takes…

Attack of The Creatives: Trey Barkett. Snapchat Photography Pioneer

Humbly, from Troy. Trey Barkett has taught himself everything he knows about photography and got into the art following his…

Attack of the Creatives: Meet Corey Favor, Co-Founder of CCF

https://www.instagram.com/p/-zGW_8TByV/?taken-by=shutupandcreate I haven’t arrived yet. I continue to grind. I asked Corey Favor who he was and he told me…

Everyone Here Has a Vision: This is Magna Media Group

Think Magna. Good Music is Good Music https://www.youtube.com/watch?v=VCb0pjhJtyc With 1983’s Wildstyle on the TV screen and legendary hip hop and…

How to Make it in Promo: A Conversation with Social Entrepreneur LaVelle Stillwell

LaVelle Stillwell is the Head of Promotions at XO Nightclub and the CEO of LA Productions. As a graduate from…

Letter From The Editor: Say “Black Lives Matter” Like You Mean It

Some people are so afraid to die that they never begin to live – Henry Van Dyke. My view on the…

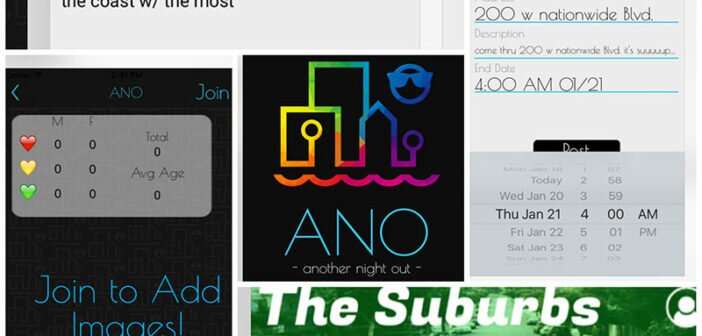

Are You Ready For “Another Night Out”

When there are apps that find you a ride, apps that you arrange for food delivery, and even apps that…

Wear Your Shoes: Sneakerhead Retro Reese and the Story of His Soles

With the proliferation of social media and technology, sneakerhead culture has risen to the forefront of popular culture. What once…

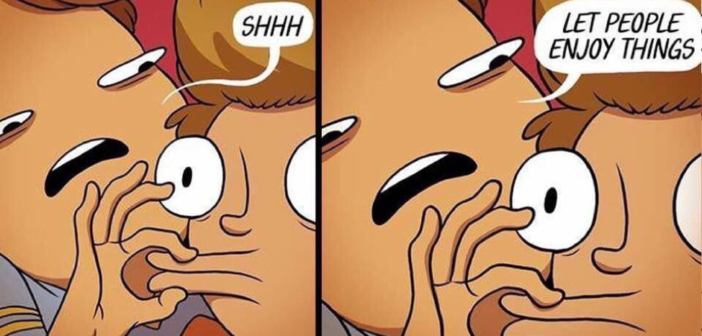

Shut Up and Let People Enjoy Things: The Dangers of Being Too Woke

“To be black and conscious in America is to be in a constant state of rage.” – James Baldwin That…

Making Statements Off Fly Street

Custom Is Fly This gem was spotted at the Columbus Fall Flea. Have something to say? Put it on a…

Mental Illness Isn’t a Bad Thing, But Silence Is

Depression is Real But We Treat It Like Fiction According to the New York Times, suicide related deaths are the…

The #FlyPaperWCW: The Godmother of Vegan Soul Food, Ruby White | @tudey__

FlyPaper Celebrates Women’s History With WCW: Ruby White As stigmas often go, it’s not very often that vegan and soul food are grouped…

OP-ED: Donald Trump is Fresh Meat For The Savages

I’ve been trying to keep my comments to myself but it’s been hard. Thing is, I keep seeing all of…

Nancy Pelosi Didn’t Blow A 3-1 Lead

2016 seemed to be a year of the uprising of the unpredictable. In pop culture and social media would…

Nintendo Switch & PlayStation Vue: The Console War Expands

The console war is a topic that always reoccurs within the gaming community. Different companies that own gaming systems are…